Staking cryptocurrency is a comparatively new way of participating in a crypto network. Previously, participation was primarily limited to those who could contribute hardware, electricity or computational power via Proof-of-Work mining to ensure network security while earning rewards, but now it’s open to all thanks to Proof-of-Stake blockchains. All you need is the cryptocurrency itself.

Let’s first understand the fundamentals of staking and why it is needed.

Why is staking needed?

Staking is the process of effectively locking or freezing your cryptocurrency funds. In return, you get staking rewards on the amount you staked. Why is this needed? To understand that, we have to take a deep dive in how blockchain systems work and run.

Proof-of-Work

A network needs to have a consensus among participating nodes. Historically, it’s been done the Proof-of-Work way through mining. In the process of “mining” a new block on a blockchain (such as Bitcoin), you’re verifying transactions that happen on the network. This is important because if a lot of people are not actively verifying transactions on a network, bad actors can get away with rewriting the blockchain itself.

The downside is that mining requires upfront and ongoing costs – such as high-end graphics cards (GPUs) or specialized ASIC machines (specialized mining rids). It also uses a lot of energy, as all this hardware uses a lot and must run 24/7.

Proof-of-Stake

Proof-of-Stake is a fairly new concept. In this system, consensus happens by nodes without the need to mine. Transaction verification is still vital – and it is done by giving participants the power to verify transactions without having to solve any redundant or impractical mathematical algorithm. The amount staked increases the amount of verification influence.

But of course, these networks cannot trust just anyone who joins! For example, imagine someone has a huge influence or enough resources to train other people to perform repetitive tasks or acquire a large portion of the network’s validating power. This person or organization can, in theory, use this power to take control over the network, known as a 51% attack.

This is not ideal, of course.

The power to verify transactions via staking is given to those who hold a particular cryptocurrency (simply the network’s own coin) and are willing to stake or freeze it. This ensures that they have skin in the game. Now, they are more likely to work toward the common goals of the network and see it succeed than trying to game the system for any individual profit.

This process of buying and holding a particular cryptocurrency and putting it into a staking contract it is called staking.

Out of the 22,155 cryptocurrencies listed on CoinMarketCap, 176 are Proof-of-Work vs. 75 Proof-of-Stake. The surprising thing is, Proof-of-Stake coins were much rarer than Proof-of-Work just a few years ago.

The Ethereum Merge was nothing short of a global phenomenon. A large-scale transition from Proof-of-Work to Proof-of-Stake, partly due to concerns associated with rising electricity usage without any hiccups, gave developers and proponents of Proof-of-Stake networks a better, sustainable solution.

Generally speaking, staking is steadily becoming the standard of cryptocurrency ecosystems and decentralized blockchains. Today, we have many amazing projects using the Proof-of-Stake consensus mechanism, such as Ethereum, Cardano, Solana, Algorand, and Tezos.

How does staking work?

In simple terms, staking is the process of buying cryptocurrency and freezing it on a staking platform. Note that just keeping the coins in your wallet or an exchange wallet is not staking. You gain no APY (annual percentage yield – the percent of interest earned over a year) if you just hold a coin in a crypto wallet.

All the staked crypto is actively used to validate transactions; it’s mainly there as a deterrent in case you try to fraud the system – in which case you’ll lose all or some of your assets (known as slashing). Proof-of-Stake is truly a novel system to ensure nobody tries to game the system and requires them to put up their staked assets at risk for the common goal of securing the chain.

But as we’ll see, choosing how you stake is also essential. After all, there are bad ways to stake that can lead to centralization or loss.

What are the ways to stake?

All leading Proof-of-Stake platforms provide ways for you to become a staker. From there, you only need to actively stake your selected amount of coins.

But as you already know, it is always best to diversify your portfolio.

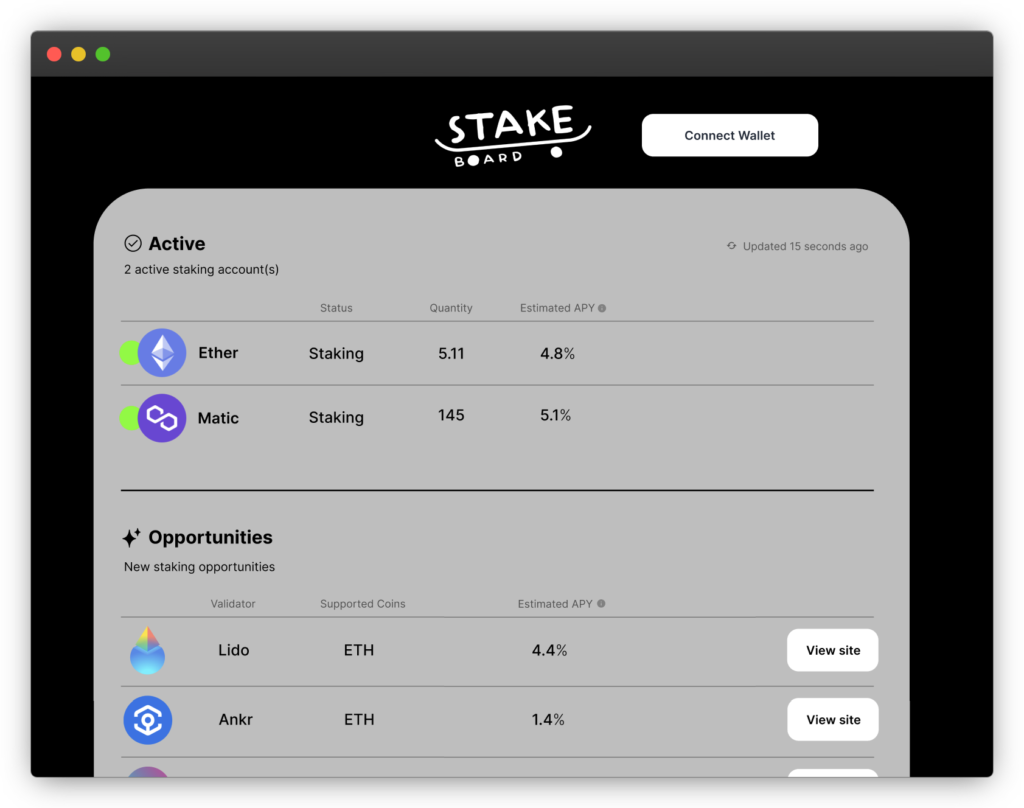

Let’s say you wish to stake ETH, ADA, SOL, and ALGO. You will need dedicated accounts on four different sites and wallets, considering you’re not going with a centralized exchange after the recent collapse and bad tidings of such platforms. Tracking the performance or re-staking, unfreezing, and updating your stake quickly becomes a hassle.

The fact that many ecosystems don’t pay much attention to the user experience and need you to be tech-savvy to activate, manage and track your staked assets doesn’t help either.

A staking dashboard that can manage and track all your staking and rewards is very useful for many, and we’re building StakeBoard to help solve that need.

Centralized exchanges and staking as a service, in general, are not the best way to hold cryptocurrencies or stake long-term – as made evident by the collapse of FTX and other CeFi projects.

Sticking to decentralized, self-custodied staking methods is the better option. In this way, you’re ensuring that no company can manipulate the network while reducing your risk of a platform failing and you losing the ability to withdraw your funds.

The importance of trustlessness

Trustlessness is a key feature of cryptocurrency staking, allowing users to stake their coins securely. Trustless staking means you don’t have to trust anyone with your funds. They say in your wallet! There is no mediator such as a bank, centralized exchange, or another CeFi entity. You can stake them directly and are rewarded by the network natively.

If you want to understand how trustless staking works, you should think about it like this: you are retaining your crypto in your self-cusotdied wallet and not into a third-party platform. Only you have access to your funds. No other party does.

Trustlessness is one of the main features that separate cryptocurrency from traditional banking. It’s also one of the most important aspects of the long-term safety of the network.

Wrapping up

Staking is freezing your coins in a decentralized and trustless system to help the network mint new blocks and receive rewards.

So why should you stake?

Stakers help increase network security by validating transactions without relying on miners or other parties who may not always be trustworthy (i.e., centralized exchanges). This way, stakers help ensure that the platform remains decentralized and cannot be hacked by malicious actors, such as an attacker who controls more than 50% of the network.

Staking’s primary value for individuals is safely earning staking rewards on their crypto holdings.

Leave a Reply